Without a doubt, one of the most annoying fees that credit cardholders have to pay is the annual fee. Majority of cardholders are familiar with this fee and majority of us likely pay this grudgingly year after year after year.

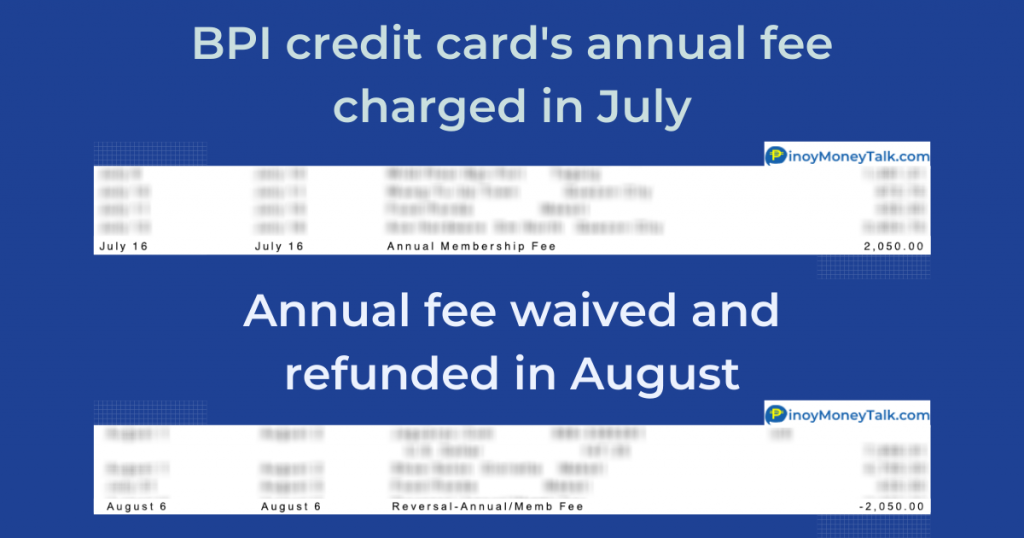

In the case of my credit card with BPI (Bank of the Philippine Islands), I’m charged P2,050.00 every year. For my Citibank credit card, it’s P2,500.00 per year. That’s a lot of cash I could have spent on other things!

Why are we charged an annual fee? Simply put, it is billed to us just because “we’re using the card”. Think of it as sort of a “membership fee” that we have to pay to be able to use the credit card. Sucks, right? Fortunately there are ways to end this annual burden. I identify below three (3) valid ways to waive or totally eliminate the annual membership fee.

I can guarantee that I’ve tried all methods below and they work! I never got to pay any annual fee with my BPI credit card since I first got it back in 2007! That’s more than P32,000 worth of annual fees that I never had to pay.

It’s a hit-and-miss, though, for Citibank (now under UnionBank) and BDO, because sometimes they waive my annual fees but other times, they don’t. In 2020, I tried Method #1 below and called Citibank but they told me that they won’t waive the annual fee but, interestingly, gave me a guarantee that my annual fee in 2021 will be automatically waived. They did!

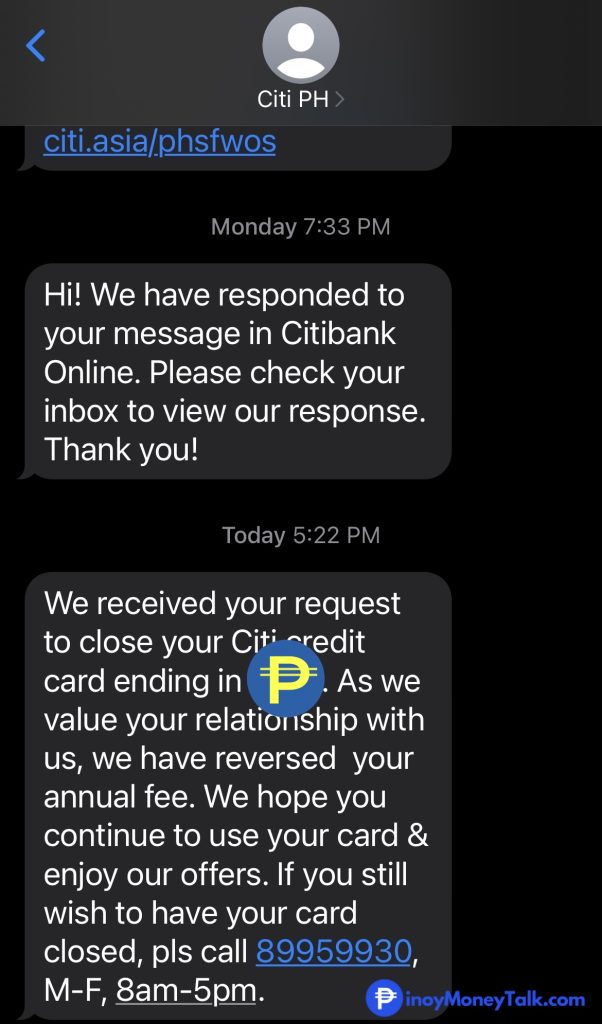

But in 2022, Citi again charged me the annual fee. I tried Method #1 again but they did not budge so I resorted to Method #2 and, alas, it worked! More details of this story below.

So how to convince credit card companies to waive the annual fee? Try any of these three (3) tried-and-tested ways:

It may not work for you every time but if it would, congratulations and welcome to the “My credit card’s annual fee got waived” club!

Check out other interesting articles below:

Not a lot of credit cardholders know this, but you can simply call the bank or credit card company and request to have your annual membership fee waived.

In fact, this is the method I’ve used every single year since I got my first BPI credit card back in 2007, and it has worked for me every year without fail — saving me more than P30,000 worth of annual fees through the years!

In 2020, BPI surprised me by instantly waiving my credit card annual fee without me having to file a request. Due to the COVID-19 pandemic, I could not visit my branch of account, but it was a delight that I didn’t have to call BPI just to have the fee waived.

Here’s the text message from BPI informing me that my annual fee has been automatically waived in 2020. Thank you, BPI!

Tip: if you’re a Preferred Banking client of BPI, you may call their Preferred Banking telephone number at (+632) 7791-0077 so you won’t have to wait several minutes to talk to a customer service (CS) agent. It usually just takes me less than 30 seconds to speak to an agent who can help me with the annual fee waiver request every time!

Still, the decision whether your waiver request will be granted depends on several factors, including your credit history and usage of the card. If you’re a cardholder in good standing, BPI typically grants this request. They usually first check your monthly card usage and payments history, and if you’ve been assessed as a customer in good standing, they usually decide to waive the fee.

One time, I called the BPI hotline to request the waiver of my annual fee. The CS representative checked how much my credit card spending was in the previous three months. I assume if I wasn’t actively using the card then I won’t be given the waiver request. After checking my card usage, the CS representative told me that I’m qualified to have the fee waived, but on the condition that I use my card with minimum spending of P20,000 within the next three months.

I asked if that amount was the required spending every month for 3 months, but I was told it’s just cumulative amount for 3 months total. Since I’ve been spending more than that anyway, I agreed and the CS representative told me to check the next billing statement and I should see a refund of the annual fee that I paid.

Annual credit card fee waived. Success!

The SMS message from Citibank goes: “We received your request to close your Citi credit card ending in xxxx. As we value your relationship with us, we have reversed your annual fee…”

It thus helps to explain that the annual fee is a big reason why you’re thinking of making the switch. You can say that you’re contemplating on using another credit card because the issuing company is offering to waive the annual fee.

Here’s a list of credit cards in the Philippines that offer waived lifetime annual fees or no annual fees forever.

| Credit Card | Annual Fee Waiver |

|---|---|

| AUB Classic Mastercard | No annual fee for life (principal and two supplementary cardholders) |

| AUB Easy Mastercard | No annual fee for life (principal and two supplementary cardholders) |

| Citi Simplicity+ Card | No annual fee for life |

| EastWest Platinum Mastercard | No annual fee for life (principal and supplementary cardholders) |

| EastWest Priority Visa Infinite | No annual fee for life (principal and supplementary cardholders) |

| Metrobank M Free Mastercard | No annual fee for life |

| PSBank Credit Mastercard | No annual fee for life |

| PNB The Travel Club Platinum Mastercard | No annual fee for life |

| PNB Ze-Lo Mastercard | No annual fee for life |

| Robinsons Bank DOS Mastercard | No annual fee for life, if used 12 times or more within a year |

| Security Bank Next Mastercard | No annual fee for life (principal and supplementary cardholders) |

After we’ve written this article, we received a lot of comments from PinoyMoneyTalk readers who shared their stories on how they also got to have their credit card annual fees waived. We’re reproducing them below so you can learn from their experience!

“I always pay the total balance on time so I never have finance charges and late fees; I have a good credit standing. I usually just tell the agent to cancel my card if they won’t waive the annual fee and they gladly waive them with no conditions.”

– Joanne M.

I have a BDO Credit Card and every time I request for waiving [the annual fee], it was always granted. Of course, need a good history of payments. But in Metrobank, they always have requirements to purchase or a condition to waive your annual fee.

– Ian

Citibank does not waive any annual fees anymore. I’ve tried. They don’t do it. I spent a whole 30 minutes to 1 hour on the phone trying to convince them. You have to have 20,000 points. Php 30 for 1 point. For annual fee to be waived, you need to have Php 600,000 spent.

– RC_KUNOICHI

Seems like Citibank does not waive annual fees this year. Called them up, failed to have mine waived.

– Vito A.

I just had requested to waive my annual fee sa Metrobank and they gave me 3 options: 1. Spend a particular amount; 2. Go paperless; or 3. Enroll a utility bill. I chose option 2.

-BJC

I have a good credit standing with Metrobank for 5 years. I pay my bills on time and always in full. But Metrobank never waived my annual fee.

– Alex

I work in BPO for credit cards and if you always pay your bill in full, you won’t get good credit standing because they don’t get to milk you through interest charges. Remember, that’s how bank earns from credit cards. They don’t get to earn from you, instead your account becomes a liability because they also spend something for their services to you. To get a good credit standing, always use your card but do not pay it in full always and make sure to keep your account current. (They also get money from you through late fees, so getting late 1x in every 8 bills perhaps will not hurt your credit.)

– Mari Ela

I tried calling BPI before and the BPI agent said that I need to spend Php 9,000 in a month for them to waive the annual fee, else I’ll be charged. So I let my co-workers use and swipe my card. My 1st year’s annual fee was waived. Will do this again on my second year.

– John David G.

Now you know some ways to eliminate your annual credit card fee burden. Try the steps above because if they work, you’ll surely be able to save a good amount of money every year! We hope to welcome you to the “Waived Annual Fees Club” soon!

*Update: Citibank credit cards are now under UnionBank of the Philippines (UBP), with the credit card name, logo, trademarks, etc. used under license by UnionBank from Citi Group Inc.

Check out other interesting articles below:

James Ryan Jonas teaches business management, investments, and entrepreneurship at the University of the Philippines (UP). He is also the Executive Director of UP Provident Fund Inc., managing and investing P3.2 Billion ($56.4 Million) worth of retirement funds on behalf of thousands of UP employees.

is a money-oriented website in the Philippines focusing on how to make money online and offline — through investing, trading, and smart money management.